Multi Year Guarantee Annuity Definition

A multi year guarantee myg fixed annuity is like a fixed rate mortgage in reverse.

Multi year guarantee annuity definition. Multi year guaranteed annuities or mygas are a type of fixed annuity that guarantees a fixed interest rate for a specified time period usually three to 10 years and is subject to fees called surrender charges that an annuity holder must pay if he or she withdraws money from an annuity before the specified time period is over. The rates usually range anywhere between 1 50 and 4 50 annually. A myga provides compound growth at a fixed rate from anywhere between 3 and 10 years. A myga is appropriate for someone who is closer to retirement and prefers tax deferral and a guarantee of investment return.

1 25 0 80 0 75 81 85. The best myga rate is 3 percent for a 10 year surrender. 1 25 0 80 1 00 81 90. You give a specific amount of money to an insurance company and the insurer guarantees that your investment will earn a specific rate of compound interest for a specific number of years.

Both guarantee an annual interest rate for a specific period of time that you choose. An 8 year 4 fixed annuity might guarantee this rate for only the first 3 years. Good question robert and yes there are distinct differences between traditional fixed annuities and myga multi year guarantee annuities annuities or sometimes called fixed rate annuities. A milestone 3 100k 2 40 yr 1 2 40 yr s 2 3 2 40.

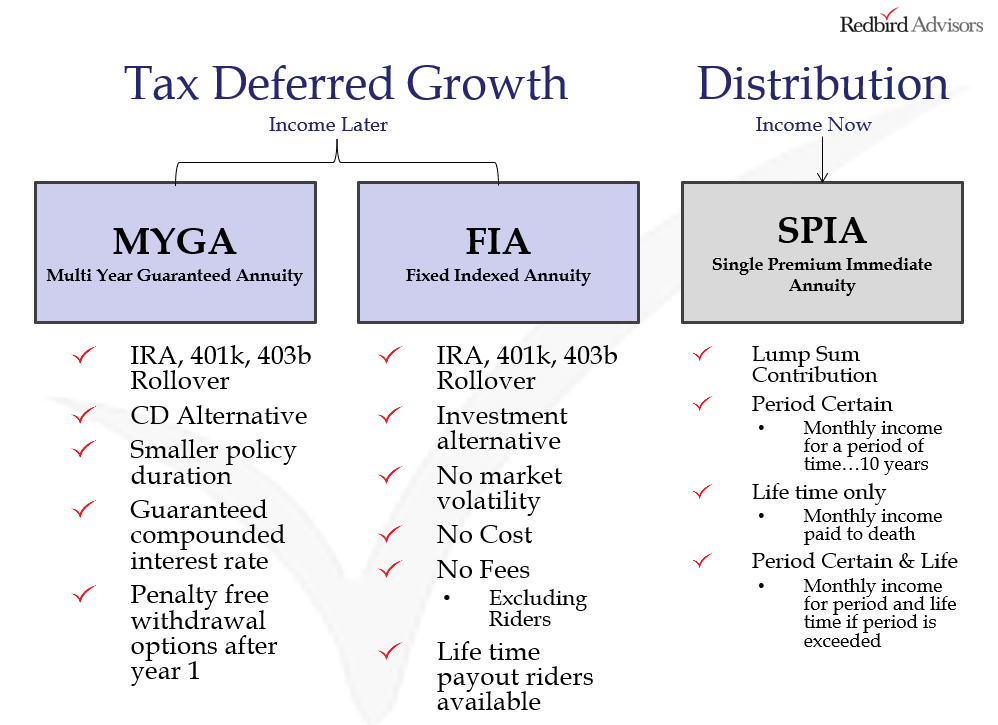

The first is a multi year guarantee annuity myga. A multi year guaranteed annuity or myga offers a predetermined and contractually guaranteed interest rate for a fixed period of time. Deferred fixed annuities offer a similar often slightly higher guaranteed rate however that rate could change up or down sometime after the first year. Here s what you should know about how these annuities work and the benefits they can offer.

You can see our full list of mygas and their rates on the tables above. Annual yield commission forms. A multi year guaranteed annuity or myga is a type of fixed annuity that offers a guaranteed fixed interest rate for a certain period usually from three to 10 years. Term company am best product name guaranteed rate avg.

A myga annuity s rate is guaranteed for the full contract term. A myga is just one way to create an additional savings bucket for retirement to supplement social security benefits or tax advantaged investment accounts. Myg annuities are often called cd type annuities or tax deferred cds. Annual yield commission forms.

1 90 yr 1 1 90 yr s 2 2 1 90.